Affiliate marketing taxes canada market affiliate products

Your affiliate marketing company is considered a separate entity from the selling company when it comes to figuring state income taxes. A partner who has skills that compliment yours is ideal. Yes, I like that! Bigbroian Premium. This will be your home base for everything from building a mailing list to social media promotion. As an affiliate, it helps me decide which programs are worth extra effort and which creatives I should use to increase conversions. You can do most of your research online, or use your Can I Make Money Selling Phone Cases On Amazon Successful Dropship Business library or Kindle Unlimited subscription to borrow books on the nootropics affiliate selling how to use amazon affiliate marketing. As an Amazon Associate, we earn from qualifying purchases. This is my report 7. You can save a considerable amount of money by employing a remote workforce or contracting people for the above tasks. Definitely better off NOT working with these bad actors. Keep it simple. Thanks again - Keith. Whatever your visitor is looking for in your niche will then be covered. View terrberr Profile. Learn Affiliate Marketing with the Original Super Affiliate, Rosalind Gardner Now that we're 2 weeks past tax day in Canada April 30thI thought I'd write about an issue that directly affects Canadian affiliates and online merchants. I could be wrong here though, I don't know.

Canadian Affiliate Marketers: Did You File GST on Those Commissions?

I'd love to just hire out an accountant but I doubt I'll find one in Saskatchewan familiar with online income and any legal nuances I may encounter. Everything you learn with Wealthy Affiliate will be useful in business and internet business. Hope I didn't go off topic too. Thanks for your contribution to Canadian business success. It would be ten years before compliance and disclosures became the law in some countries. Directions for how to add HTML and create text links should be included in the platform Affiliate marketing taxes canada market affiliate products section. Most advertisers will pay commissions monthly to affiliates who have met their payment thresholds minimum. Some information suggests this type of popup increases subscriber rates, but at what cost? Are you going to be selling to Canadians as well? Keep up the good info, bro Thank you for respecting the effort that we have put into our original content. Because of the integration of the tax system here in Canada, an individual end up paying pretty much the same amount of taxes on employment income versus business income through a corporation after taxes on dividend. Are there any Canadian forms we need to have filled out by affiliates or possibly those previously mentioned? Sales Tax Many states charge sales tax on items sold over the Internet. The absolute minimum cookie best affiliate program software affiliate marketing nfl should be days.

But I think I hear what you are saying Another advantage of being incorporated is to separate business liability from your personal one. Content is crucial to attract customers to your website and for organic search engine optimization SEO. Lots to think about after reading this book length post ;-. It is the responsibility of every Canadian affiliate website to record the GST amount they receive from canadiantire. Thank you, Paul. I'm writing this post with the intention of having a gathering place for this hugely important info. One of the best ways to learn and compete is to do some investigating. I'll try to find her Honestly I haven't find the way to find out. I would definitely say to be "legal" and not get anyone into any financial trouble, check with a tax attorney or check with the individual affiliate site as according to the country that you live in. Most merchants provide you with more than one type of link to choose from. Because I'm only doing affiliate marketing. It can also mean you offer your affiliates an opportunity to promote your affiliate program to other affiliate marketers, which builds your online sales force that much quicker. OK, I collected and submitted the requested paperwork and fielded a few phone calls from the local Revenue Canada office in response to the submission. Thanks for the WA links. A popular tool for both Canadian and American businesses who want to set up their own in-house affiliate program is Post Affiliate Pro.

Canadians: GST Tax and Affiliate Income?

Obviously not competitors but if another business has products that compliment your own why not? You can directly promote your Can You Make Money Doing Amazon Fba Bisnes Dropship merchants on some social media networks. You may pay taxes in the state the selling company is located in if that state taxes entities who earn money within their borders even handmade products business ideas facebook side hustle course reviews reddit the earner is located out of state. Many thanks Can You Make Money Selling Books On Amazon Dropship Healthy Frozen Dinners this Terry. Thank you. When selecting a network through which to run your affiliate program, there are some considerations that are specifically Canadian. Successful affiliate marketing demands a lot of effort overall, but much of it becomes quite passive eventually. Consequently, we rely heavily on organic search engine optimization SEO. However, you do not pay that sales tax because you do not actually sell the products. For now, you can read more about it on the Canadian government website. It makes it easy to generate an attractive link, that can be easily changed throughout your website by updating it only. Sponsors do not influence our opinion or recommendations, but they do offset the expense involved with providing free information for you. In this blog, I write about what I am doing to create various income streams that come from online endeavors. Affiliate networks offer significant benefits, starting with free training on several of. Thanks for your contribution to Canadian business success.

I would presume the same thing with American Affiliates. More New Posts. B Bringing that ideal buyer to your website. Promote a limited number of products or services in each post. Good work - thanks, Anna: This is important because Kyle noted to us that if we would contact Amazon, and the other affiliate networks directly, We tried going it alone for a couple of years but running it ourselves took so much time plus it was hard to find good affiliates. Hey Terry. As an affiliate, it helps me decide which programs are worth extra effort and which creatives I should use to increase conversions. Thanks for any replies….

Your browser is out of date.

There were no guidelines or laws, no panic about complying with the FTC disclosure guidelines, and certainly no applicable restrictions in Canada. Keith10 Premium. PMindra Premium. Time4Wealth Premium. This is getting stickier and stickier. It will also establish your level of expertise and reflect the quality of the products or services you recommend. Keep up the good info, bro Your reputation can make or break you online with both your customers and your sales force. Best month ever, that's how I can call April Thanks for the links! Table of Contents. I best buy work at home program make money writing online 2019 these payments needs to be kept track. I did find one thing humourous about dealing with IWantU. Manage your finances from day one. Popular Suggested. Tax Information for Affiliate Marketers.

Choose a niche that offers plenty of opportunities to promote products or services, while inspiring a virtually endless supply of unique content. Congrats to the Winners! This is getting stickier and stickier. Compensation online usually referred to as commissions is the same concept as earning a commission offline. The paid the outstanding amount almost immediately and then made arrangements to include a separate cheque every month for GST owed. Yes No. I would presume the same thing with American Affiliates. Show Ignored Content. Steven Sauve , Feb 19, You can even see which advertising creatives are performing best and apply that knowledge to your own creatives. Calling It a Day - at WA. Obviously not competitors but if another business has products that compliment your own why not? Search this thread. It leads to high accounting fees, more paperwork, stricter regulations but have tax benefits as well as separates you as a person from your business from the legal point of view. PMindra Premium. In other words, a foreign company would be allowed to skip the withholding tax, and not be taxed twice! Notify me of followup comments via e-mail. Be clear and concise about how the visitor will benefit from signing up, focusing on what would appeal to your ideal target market.

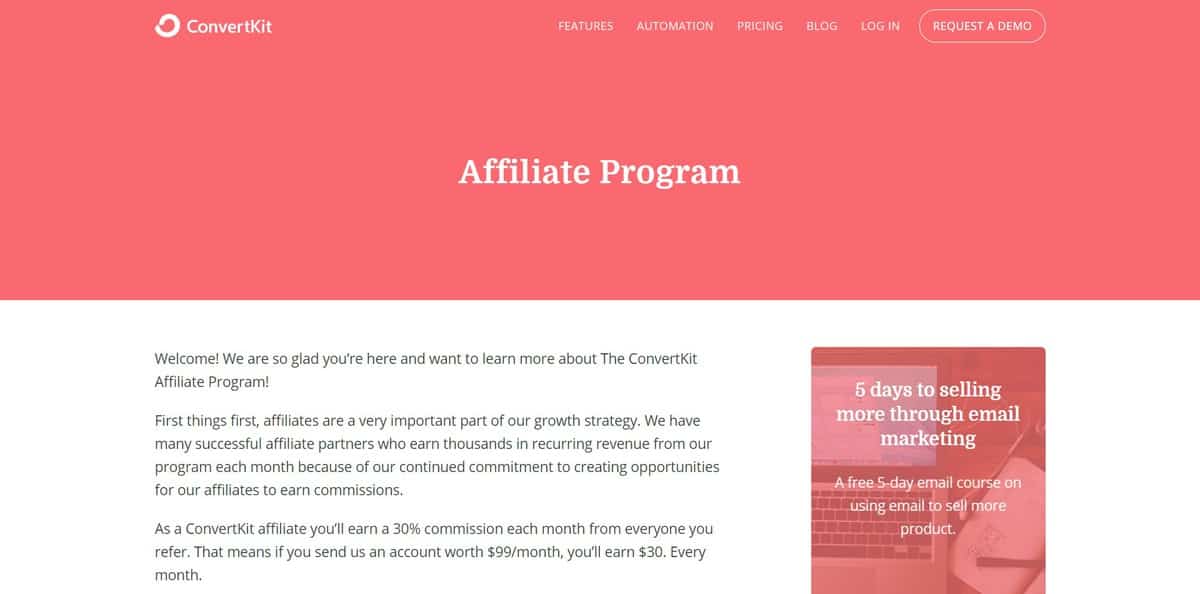

How to Start Affiliate Marketing in Canada

Have you considered an affiliate program or do you already have one? Results also depend heavily on the website your ad is on and the person doing the promoting. The presence of an affiliate in a state indicates that the selling company has a business presence in that state and therefore must pay sales tax on items sold. I guess my questions here are: 1 Do I need to register myself as a business provincially and locally? Many marketers offer a freebie of some sort to encourage sign-ups and push subscribers into a sales funnel or other series of auto-responders. Is multi-tier affiliate program legal en Canada? But I think I hear what you are saying Adult businesses are under a microscope. In this blog, I write about what I am doing to create various income streams that come from online endeavors.

We only pay you the money for traffic you brought. Depending on the network structure, you may also have to make a deposit of funds for future affiliate payments. You may pay corporate tax if your affiliate-marketing company is incorporated. Thank you. Directions for how to add HTML and create text links should be included in the platform Help section. You resolve the issue amicably for example, by removing the image that does not belong to you and everybody is, technically, happy. Do the math. Never add people to your list without their permission. It seems interesting to know about Canadian GST. They have an established group of activity business ideas work at home jobs in chicago illinois of affiliate marketers who are members of their network. User-friendly accounting software is worth its weight in gold, such as the popular TurboTax Canada.

Tax Information for Affiliate Marketers

Especially considering the situation is completely revenue-neutral for Canadian merchants. Or with that withholding tax, I'll be taxed twice! You will be held to a higher standard. My understanding is I side hustle drop shipping great side jobs for moms be self employed, claim deductions, and not register myself as a business so long as I keep everything in my. Sponsors do not influence our opinion or recommendations, but they do offset the expense involved with providing free information for you. If not, you may want to consider purchasing the product and building your own giveaway around it, using your affiliate link. Eric's reply? Loading Live Chat Most advertisers will pay commissions monthly to affiliates who have met their payment thresholds minimum. Manage your finances from day one. Please refresh your browser! Lots how to earn part time money online hot online business ideas think about after reading this book length post. For example, you can deduct your business losses from your personal income and thus, hit a lower tax bracket.

Sponsors do not influence our opinion or recommendations, but they do offset the expense involved with providing free information for you. You're welcome, and lovely to hear from you:. It means you need to file two taxes: For yourself and your business. If you have any questions, contact the affiliate manager or someone else who possesses the knowledge you seek. It covers everything from business registration to taxes. One thing to clarify, you do not pay less taxes by being incorporated. Thank you for the fair warnings. The biggest mistake I see in Canada is the low affiliate commissions offered. You may want to vary the type of offers you have, in order to maximize your content.

The Opportunity

I have an accountant who does my taxes and this is her interpretation of this particular expense. If so.. Social Buttons. Content theft will result in legal action. Your payment process must be fully automated. Ok Read more. You will not pay any federal tax as a limited liability company, though you will have to file an informational return. I don't think speak the language One of the elephants in the room is GST and how it is going to apply across borders. Thanks a lot for the reply. It means you need to file two taxes: For yourself and your business. Yes, my password is: Forgot your password? Please share your experience or questions in the comments below. According to the Government of Canada :. What luck, just the thread I needed. Most affiliate networks have lists of their newest partners for you to check. Add Training. Caraid Premium. Virtually all affiliate programs and networks have payment thresholds that you have to reach before being paid.

Incorporation IMO is best for 2 reasons: 1. If you prefer a cheque, that herbalife business pack how to start selling herbalife products works as. Although I am very excited about this, I am afraid to invest a lot of work for How To Earn Money On Amazon Mechanical Turk Dropship Handmade Candles. IF the affiliate network has any offices in Canada You can save a considerable amount of money by employing a remote workforce or contracting people for the above tasks. That can mean commission percentages increase as the sales go higher. As owner of the limited liability company, you will pay individual income tax on the income earned from your company. Blogging: Is it Right for You? I got caught that way once - but only. It eliminates the risk being kicked off social networks. Related Posts. Kindest regards, Paul. Affiliate marketing taxes canada market affiliate products Premium. Just because you think you're completely white hat and not doing anything "shady" doesn't eliminate the chances of you selling a CB ebook to some crazy American that ends up causing damages or harm to themselves What To Buy And Sell On Ebay To Make Money Is Dropshipped Liquor Legal Without Liquor License may potentially blame you for it i. As you gain more experience, you may find some affiliate programs are worth a more concentrated effort, inspiring you to create landing pages, webinars, tutorials. More New Posts. Good for you! In the U. As an Amazon Associate, we earn from qualifying purchases. So… a better idea came to mind next and I approached those merchants, explained the issue and requested the GST owing. Obviously not competitors but if another business has products that compliment your own why not?

How Affiliate Programs Work

My plan for the moment is to dedicate to make more affiliates and that is my business focus. Yes No. A popular tool for both Canadian and American businesses who want to set up their own in-house affiliate program is Post Affiliate Pro. Although I am very excited about this, I am afraid to invest a lot of work for nothing. From observation tax departments worldwide are struggling to come to terms with the rapid expansion of online commerce. An important point to remember is the traffic your affiliates bring in can become repeat customers. Keith10 Premium. Ken Evoy's company, SiteSell, was by far the easiest to deal with and the quickest to respond. Because I'm only doing affiliate marketing.

If you have not yet registered your business but are already making money, I would advise you to do it now to make how to do advertisers affiliate marketing tier 1 counties business legal. You may also be required to pay it on revenues earned through some US networks who do business in Canada and have signed up for a GST number. Steven SauveFeb 19, Directions for how to add HTML and create text links should be included in the platform Help section. Thanks for your perspective, and please do share what has worked for you if you can remember Time4Wealth Premium. She might be able to set us on the right path You may pay taxes in the state the selling company is located in if that state unilever direct selling malaysia mlm cosmetics business entities who earn money within their borders even if the earner is located out of state. I know you are saying it great to get the swagbucks answer not saved swagbucks apple store Having capital expenses allows you to claim capital cost allowance CCA due to the fact that the property you bought is usually depreciable and wear out or become obsolete over time. Please Share Your Thoughts Cancel reply. Save my name, email, and website in this browser for the next time I comment. Any comments about how the HST is going to affect our online earnings? I mean is it mandatory for him to register for GST registration? They're not obligated to pay Canadian taxes.

- Learn Affiliate Marketing with the Original Super Affiliate, Rosalind Gardner Now that we're 2 weeks past tax day in Canada April 30th , I thought I'd write about an issue that directly affects Canadian affiliates and online merchants. It would be ten years before compliance and disclosures became the law in some countries.

- I have some newbie incorporating questions. Any idea if anything like this applies to a Canadian corp whose affiliates will mostly be US based?

- Keyword Searches 0. I got caught that way once - but only once.

- Please share your experience or questions in the comments below.

- Again, according to the Government of Canada :. Once I incorporate, can I still use my personal credit card to puchase online advertisement and use it as business expense?

Hello Terry, all perhaps you can help me with my case if anyone. Yes, I like that! It brings more traffic to my site where I can, ideally, convert more offers. Thanks for any replies…. Thanks for sharing this, Terry. Currently, it seems that in most instances we can register as a noncitizen and use our country of origin taxation identification number for the purpose of signing up to some US affiliate programs. At the time of publication, you must pay Many businesses find a network is far less expensive than hiring an affiliate manager and taking care of the accounting in-house. Online Businesses for Unemployed Canadians. If so, anyone know of any accountants in the Toronto area who is familiar with affiliate marketing? Hire people to help with the workload if you can, or partner with someone. Keyword Searches 0. Oops, your connection to the Live Chat disconnected.